.png)

Poor cybersecurity can lead to severe consequences for credit unions, including data breaches, financial losses, and reputational damage.

Market IQ Cyber, as part of the Market IQ Suite, helps prevent these issues by providing real-time visibility into vendor risks and proactive threat identification.

Powered by SecurityScorecard, it enhances your credit union’s security posture, protecting against potential cyber attacks and their costly repercussions.

Relying on third-parties means trusting their downstream compliance with regulations such as GLBA, NCUA and PCI DSS. If they're non-compliant, so is your business and you could fail external audits and be penalised.

Automate compliance monitoring with a Market IQ Monitoring & Escalation Workflow - suitable for all types of ESG requirements - that streamlines risk assessments, vendor due diligence, and data protection measures.

Workflows ensure that all actions taken during compliance monitoring are meticulously recorded, easily accessible, and retrievable for auditors.

-Mar-27-2025-01-21-11-8144-PM.png)

-3.png)

Enhanced due diligence on critical vendors safeguards sensitive information, reduces the likelihood of cyber threats, and ensures business continuity.

Categorise and tier which relationships require more attention by assigning criticality levels to vendors.

Proper categorisation reduces the likelihood of disruptions from vendor failures, safeguarding the credit union's data, reputation, and member trust.

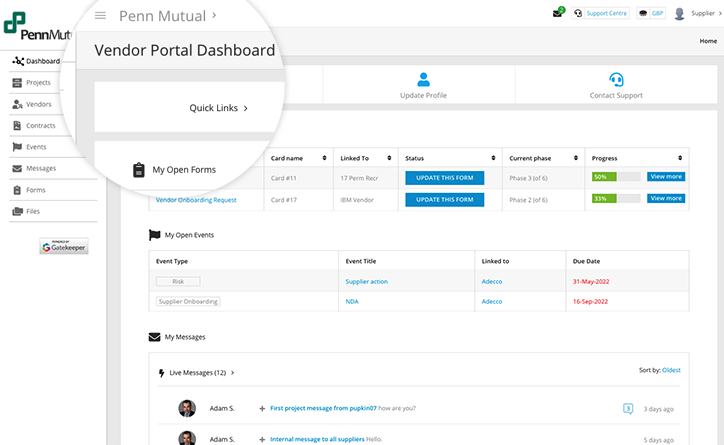

Streamline vendor management by centralising communication, documentation, and compliance tasks in a dedicated, branded portal.

By automating and organising onboardings, our vendor portal reduces administrative burden and ensures a more efficient and transparent vendor management process.

Allow vendors to submit required information, certifications, and updates directly, ensuring that all data is up-to-date and easily accessible.

.jpg?width=800&height=506&name=Smart%20Forms%20-%20scorecard%20(1).jpg)

Eliminate manual performance tracking via spreadsheets. Score, monitor, and improve vendor performance directly within digital workflows.

Access and analyse performance data directly from vendor records. Identify areas for improvement and achieve better outcomes from your relationships.

Strategic vendor performance management, efficient operations, and robust risk prevention enhances service quality and increase members' trust in the credit union.

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.