Procurement and vendor managers are under continual pressure to deliver greater value from their contracts and vendor relationships. Without accurate and timely information, decision making can be hit-and-miss.

To make matters worse, historical spend data is not always available, can be poorly classified and often contains errors.

If this sounds familiar, then read on for some practical tips to improve the visibility of your spend.

Spend analysis is a window into your business. So what are you seeing currently?

Historical data is often patched together from accounts payable transactions or by totalling general ledger categories to provide a rough overview. This may give you a rough idea, but isn’t detailed enough to make reasoned decisions from.

What you need to know for your spend analysis

- Who is spending it and on what, and with whom

- What the total controllable third-party expenditure really is

- Which vendors supply more than one business unit

- Which business units buy the same or similar goods and services at different rates

- How many payment transactions were made and the associated administrative cost

These insights will highlight wasteful expenditure and provide opportunities for consolidation, leading to cost savings.

For example, one aim of indirect and direct spend analysis is to identify how much of your spend is with critical vendors. This in turn can help you focus on getting the best value from them and consolidating those relationships.

Look at the past twelve months’ data and expect to be surprised. If your business is of a reasonable size, there are likely to be many low-value transactions, with multiple vendors, across many business units.

Before you make any decisions…

Adding up the payments to vendors through your regular procure-to-pay (P2P) channel does not always tell the full story, which is why indirect and direct spend analysis is important. Purchases are often made on credit cards and large foreign transactions may have been made directly through treasury.

The key is to ensure that all data sources are included and that data is “cleansed”, i.e. there are no errors in the coding of transactions and that any mis-spellings, vendor duplications and abbreviations have been fixed. Having the full picture is vital to ensure you’re making the right decisions.

So where to start?

Having access to reliable, accurate and timely spend data means that you need to have the right processes in place.

To know who is spending, on what and with whom, you’ll need to know exactly where all the data is held. Depending on the maturity of your organisation, spend data can be stored in a variety of ways including Excel spreadsheets, inboxes, shared drives or filing cabinets.

In this scenario, data can be easily lost, duplicated, rewritten or even entered incorrectly from the outset. Tracking spend and making informed analysis and decisions based on the information you have can prove difficult and so investing in a vendor management system can help you to take control.

Gatekeeper can help you to:

- Centralise your data, giving you complete visibility of your spend

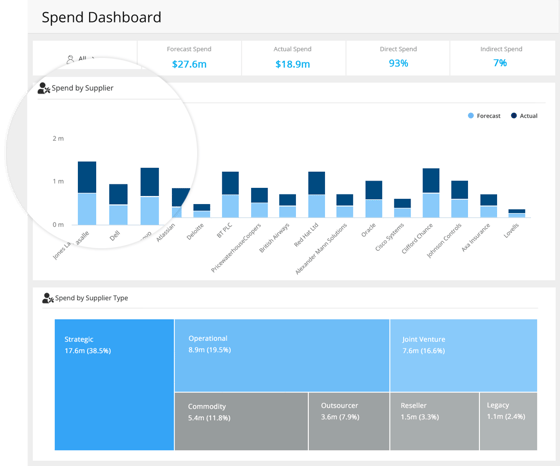

- Visualise data in a customisable Spend Dashboard

- Create in-depth reports so you can drill down into required information you need

- Import spend data from existing third-party systems such as Netsuite via API integration

Gatekeeper's Spend Dashboard

Gatekeeper's Spend Dashboard

Once you're happy that you have accurate data, mapping your spend into category “buckets” is the first step to gaining some visibility. If you don’t already have a formal procurement category structure in place, you can start by creating broad groupings of commodities.

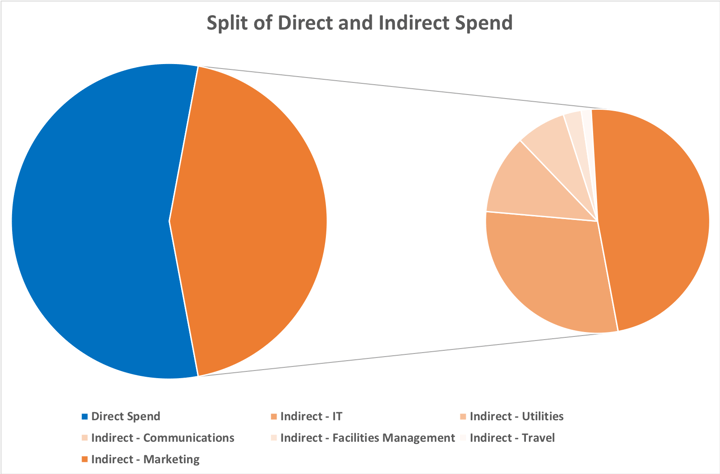

One approach is to divide the historical spend into two groups, one for direct spend (this is expenditure that is directly linked to your core business) and one for indirect spend (goods and services necessary to support the business).

- Direct spend refers to the purchases of goods and services that are directly incorporated into a product being manufactured or are goods for immediate resale. Examples include raw materials, subcontracted manufacturing services and component parts.

- Indirect spend is needed to support your business operations. It is likely to include some or all of these: I.T., utilities, communications, facilities management, travel, marketing services, transport and logistics.

The next step would be to develop your spend map by dividing commodities and services into sub-groups. You can choose your own category hierarchy or use an existing coding method such as UNSPSC.

This will allow you to find cost-saving opportunities and identify risks. Here is an example of how you could visualise your spend data:

Gatekeeper's Spend Dashboard

Gatekeeper's Spend Dashboard

The results are illuminating

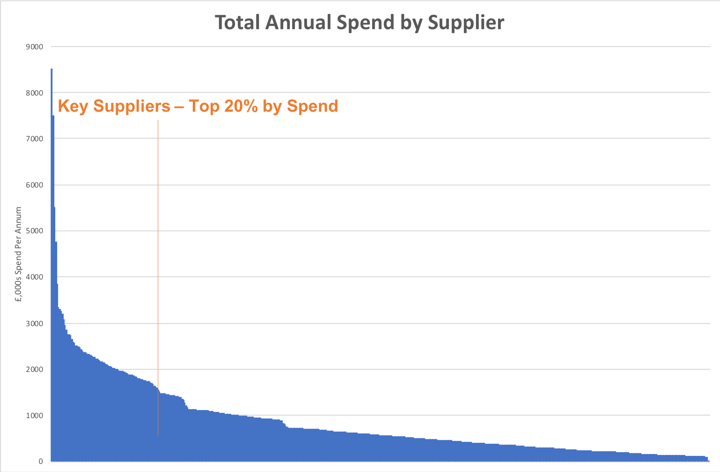

Immediately you can see what portion of your spend is with your core vendors (e.g. top 10-20% by value).

The total number of one-off and small value vendors (the tail spend) will be greater than you imagine. This information can be used to make decisions about streamlining and leveraging spend by identifying contract leakages and maverick spending.

Ideally, you should aim to reduce the number of vendors in each category as part of optimisation efforts in your procurement strategy.

Value is obtained by aggregating your spend rather than splitting it and this also reduces your administration costs.

Five tips to Improve Indirect and Direct spend analysis

- Access all spend-data sources within and outside your business. Sometimes your vendors or affiliates have better data than you.

- Cleanse your data. Payments are often made outside your financial system, through third parties or to one-time vendors.

- Do your spend analysis down to the most detailed level. This should be such that you can identify the buying entity, the item bought and who from. Aim for 95% accuracy.

- Increase the frequency of your analysis. The business environment is dynamic and prices change, vendors fail and contracts expire.

- Continuously improve your spend analysis and automate where possible. Spend data is a work in progress.

When there is reliable, accurate and timely spend data available use it effectively.

Get a march on your competitors by boosting your the visibility of your spend and using it to reduce costs. To find out how Gatekeeper can help you with spend analysis, book a demo today.

You can also read our accompanying article on effective vendor management in 2022 to gain further insight into how to generate more value from you vendors.

.png)

.png)

.png)

-4.png)