Positive working relationships with vendors contribute hugely to the success of businesses; choosing the wrong ones or failing to manage them effectively is costly, both in time and money.

Outsourcing, especially of services and manufacturing, increases the level of risk and changes the level of vendor oversight and management required.

Many companies talk about working collaboratively with vendors but struggle with building relationships in a structured way, maybe because of being unsure of how to proceed.

Here we offer some guidelines on how to classify or segment your supply base to generate more dialogue and reduce your exposure to supply risk.

The Purpose of Why is vendor segmentation

Some vendors are more vital to the business than others and need a higher level of engagement. By segmenting vendors, i.e. by classifying each one using pre-agreed criteria, we can decide upon an appropriate level of attention needed to ensure that they deliver superior service or products to us.

By then tailoring our efforts and resources we can identify which vendors can help us most to create a competitive advantage.

Segmenting vendors can provide insights into your supply base that highlight to what extent each company is important to your business operations. It allows you to develop a closer working relationship with key vendors at many levels, executive, operational and transactional.

By categorising vendors you also identify your level of exposure to risk. For example, many companies have single sources of supply for critical goods and services. Failure of any one of them can cause major disruption and an inability to satisfy your customers.

Factors that influence segmentation

There are various ways of segmenting third-parties depending on the industry you are in and your type of business.

Before we look at some suggestions on how to do it, let’s look at some of the questions that will provide answers to help you with the classification process.

- What is your annual expenditure with each vendor?

- Can you apply a risk rating to each of your vendors?

- To what extent does each vendor deliver innovative ideas and continuous improvement?

- Are there any vendors that you rely on for systems and processes?

Types of vendor segmentation

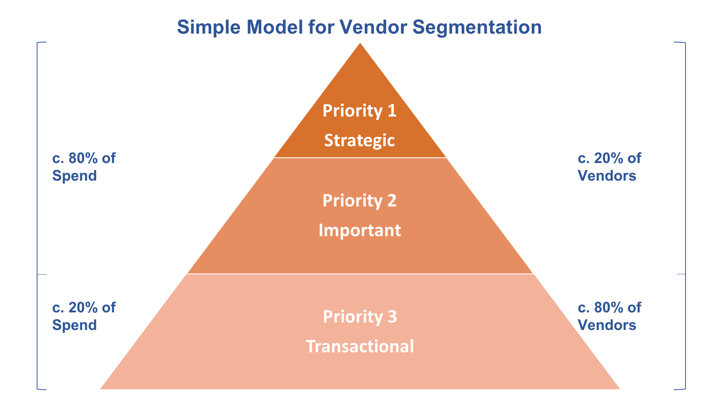

Armed with answers to the above questions, you have enough information to start the vendor segmentation. At the simplest level, the Deloitte priority model can help to classify three groups of suppliers, based on business criticality.

- Priority 1 would include a small number of strategic vendors

- Priority 2 would cover a larger number of important vendors

- Priority 3 will include the rest, mostly low-value but high-volume suppliers.

Small and mid-size companies can successfully use this model. We suggest that you approach it like this:

Priority 1: Strategic

Potential partners, alliances and sole-source vendors fall into this smallest group. They often supply high-value and low-volume goods or services that are vital to your business operations.

These vendors are helping to grow your business by making investments in technology and new-product development.

Vendors in this group are high risk and should be monitored closely.

Priority 2: Important

These vendors are those that are required to allow your company run on an everyday basis. There are alternative sources of supply if they fail but it would be inconvenient or stressful to change.

Risks are related mainly to quality, service and reputation. The focus is on vendor performance and contractual obligations.

Priority 3: Transactional

This is the largest group of vendors that make up the “tail-end” of your third-party expenditure. They supply easily replaceable commodities or services and the risk level is low.

They are usually monitored on their conformance to price and service levels only.

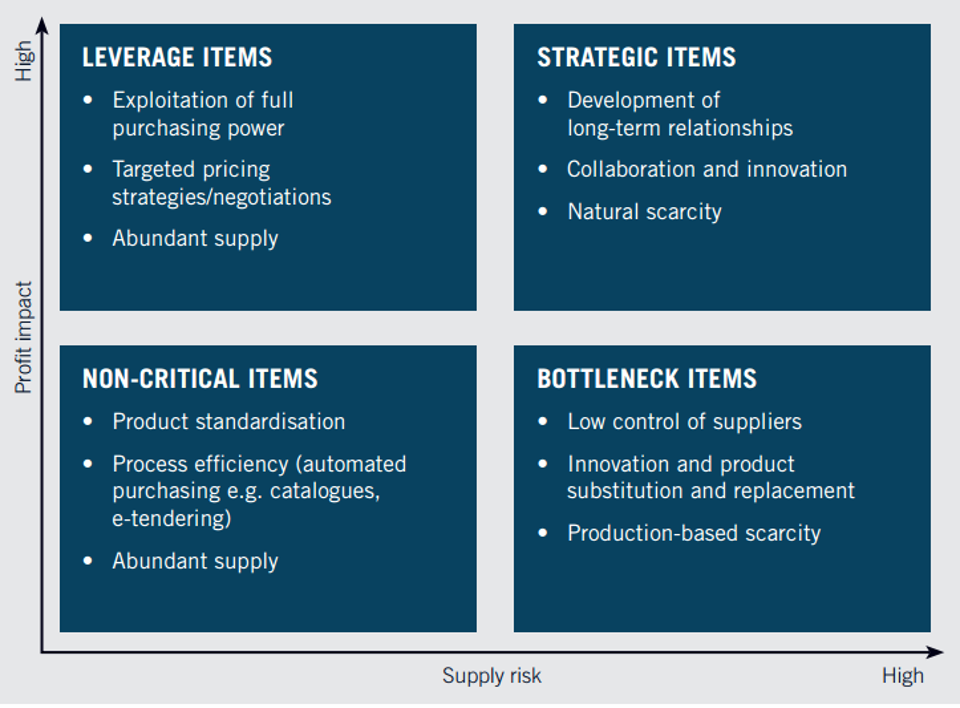

Larger organisations with big supply bases and mature supplier relationship management (SRM) programs might use the Kraljic Matrix.

The model, designed by Peter Kraljic in 1983, considers the importance of risk and the profit impact on the business and is one of the tried-and-tested ways to accurately segment vendors. It requires considerable resources and is best applied using automated tools.

Whatever the method of segmentation used, the result should allow you to select the appropriate level of engagement with vendors.

Those in the strategic group may only represent 10% - 20% of your third-party annual spend but it makes sense to put your focus there and anticipate and prevent any possible disruptions.

Reviewing your segmentation at least annually is essential, it may cause you to realign some vendors and will help refocus. The external economic and business environment is dynamic, companies’ fortunes can fluctuate causing their risk profile to change.

The failure of a key vendor to supply can even shut down business operations and cause reputational damage.

For more helpful advice on supplier management best practices, effective vendor management and vendor spend analysis you can read our related blogs.

.png)

.png)

.png)

-4.png)