Scaling The Vendor Onboarding Process For Growing Financial Services Institutions

16:49

This website stores cookies on your computer. These cookies are used to improve your website and to provide more personlised services to you, both on this website and through other media.

To find out more about the cookies we use see our Privacy Policy.

Rod LinsleyApr 17, 2025 10:15:12 AM

Vendor onboarding is the first step in vendor lifecycle management, covering due diligence, ongoing compliance, performance monitoring and risk mitigation throughout the relationship.

Business growth can easily stress the processes and practices used in vendor onboarding, by generating transaction volumes not previously considered or catered for. It can highlight shortcomings in the capability and capacity of processes, people and technologies.

Scaling, the strategic reconfiguration of processes to accommodate growth, ensures operational consistency, maintains compliance, and reduces risk as volumes and complexities rise.

This article explores key vendor onboarding challenges in growing Finance Services Institutions (FSIs) and outlines best practices to support vendor onboarding at scale, ensure compliance and manage risk effectively.

Vendor onboarding in financial institutions requires careful resource and risk management. Common challenges - and their impact on the process - include:

Manual data entry, document handling, approvals and compliance checks are still common in many financial services – but they come at a cost.

In financial services, where regulatory scrutiny is high and risk exposure can be costly, limited oversight of vendor onboarding is a critical weakness.

Addressing these challenges head-on enables FSIs to strengthen compliance, improve operational resilience, and onboard vendors in a way that supports sustainable growth.

Financial services institutions must comply with a vast and evolving web of regulations - including GDPR, SOX, MiFID II, DORA, BCBS 239 and more - each carrying unique, jurisdiction-specific obligations. As onboarding volumes increase, meeting these obligations becomes exponentially harder.

Common issues to be dealt with include:

For an FSI, vendor onboarding involves evaluating each vendor’s ongoing ability to safeguard sensitive financial data against cybersecurity threats. Inadequate assessments can leave the institution vulnerable to data breaches, fraud, financial penalties and reputational harm.

Key areas that must be assessed include:

Financial data is a prime target for cybercriminals, making a proactive approach essential. Onboarding processes should incorporate:

As vendor networks expand, these security checks must be built into scalable, repeatable onboarding processes to protect both data and reputation.

Scaling vendor onboarding isn’t just about doing more, faster. It’s about doing it consistently, compliantly and confidently as your vendor base grows. These six best practices help FSIs build a foundation that supports growth without sacrificing governance or increasing risk:

By reducing friction and improving efficiency, standardisation enables FSIs to scale without needing to redesign processes for each new vendor.

With better risk visibility up front, FSIs can grow their vendor base with confidence - not blind spots.

Vendor and Contract Lifecycle Management software removes manual bottlenecks, allowing FSIs to increase onboarding capacity while maintaining speed and consistency.

Continuous monitoring helps FSIs scale their vendor base without sacrificing governance.

Human oversight ensures that scalability doesn’t come at the expense of strategic thinking or regulatory resilience.

Having scaled the vendor onboarding process, the final best practice involves confirming that the scaled process is effectively handling the growth of the FSI, and producing the desired outcomes for the FSI and its vendors.

The following metrics provide a clear indication of the success of the scaling:

By tracking these metrics, the FSI can gain valuable insights into the success of its scaling programs and make data-driven decisions for further optimisation.

For legal and procurement professionals in financial services, scaling vendor onboarding often means more admin, more compliance pressure, and less time to focus on strategic work.

A robust vCLM platform removes the bottlenecks from vendor onboarding - helping you onboard faster, ensure compliance from day one, and manage risk at scale without adding to your team’s workload.

Here’s how the right platform helps you scale with confidence:

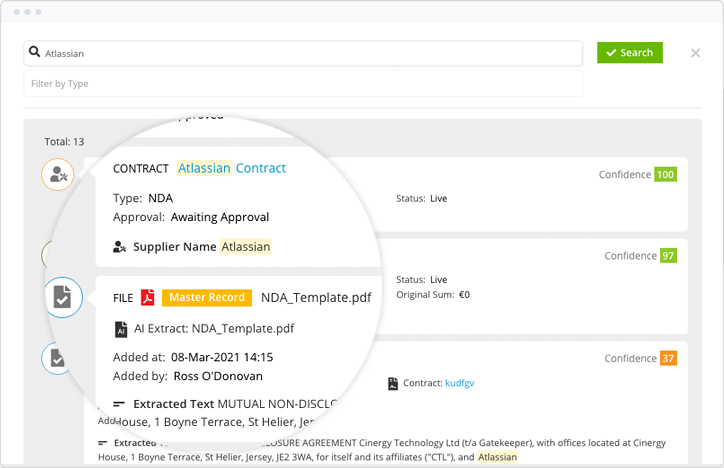

Managing vendors across spreadsheets, inboxes and shared drives doesn’t scale. A vCLM platform brings everything together in a centralised repository.

Manual processes increase the risk of missed steps and inconsistent compliance. Workflow automation simplifies and enforces best practices.

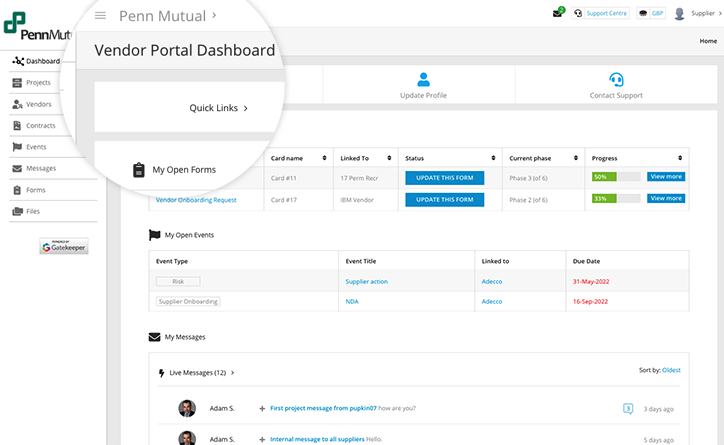

Chasing vendors for documents and due diligence slows everything down. A dedicated vendor portal puts them in the driver’s seat.

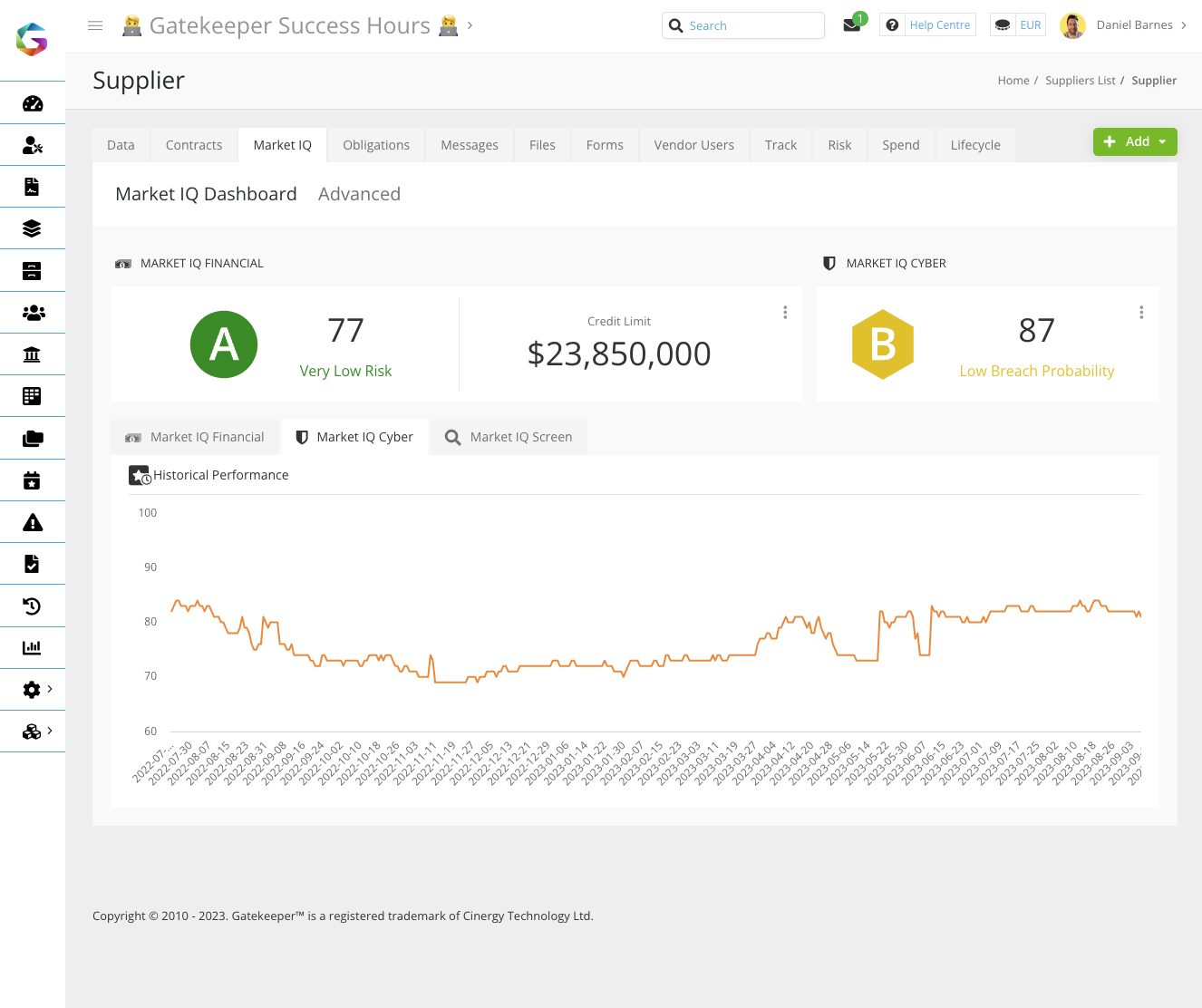

Evaluating vendors manually is time-consuming. It’s also unsustainable at scale. Built-in risk tools standardise and accelerate decision-making.

Staying compliant shouldn’t depend on manual effort. Built-in compliance tools keep things moving and your business audit-ready.

.jpg?width=724&height=468&name=Screenshot%20-%20GK%20-%20Document%20Expiry%20Kanban%20-%20Sept%2021-min%20(1).jpg)

Scaling vendor onboarding in financial services institutions involves addressing sector-specific challenges through strategic investments in capability and capacity expansion, robust due diligence, process standardisation, and continuous improvement.

It’s a strategic imperative driven by the need to manage increasing vendor volumes, navigate complex regulations, and mitigate potential risks.

By embracing scalable vendor and contract management software and implementing best practices, FSIs can transform their vendor onboarding process from a potential bottleneck into a strategic asset.

Gatekeeper equips financial institutions to onboard vendors efficiently, manage compliance, and mitigate risk - supporting sustainable growth and operational excellence.

To discuss how we can help you conduct effective vendor onboarding, contact us today.

Rod is a seasoned Contracts Management and Procurement professional with a senior IT Management background, specialising in ICT contracts

Sign up today to receive the latest GateKeeper content in your inbox.

Copyright © 2015 - 2025. Gatekeeper™ is a registered trademark.

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.