Stop Revenue Leakage With Contract Reminder Software Built for CFOs

8:41

This website stores cookies on your computer. These cookies are used to improve your website and to provide more personlised services to you, both on this website and through other media.

To find out more about the cookies we use see our Privacy Policy.

Contract Management, Contract Risk Management, Contract Management Software, contract renewals, contract reminders, Contract Reminder Software, Visibility

Shannon SmithApr 2, 2025 11:45:00 AM

Manual contract tracking is costing your business more than you think.

Beyond the administrative headache, it's creating financial leakage, compliance vulnerabilities, and eroding your ability to drive commercial value from your vendor relationships.

This isn’t just an operational inefficiency. It’s a direct threat to your bottom line.

What’s needed isn’t simply software that sends calendar reminders. Your business needs a solution that powers automated workflows, mitigates financial and compliance risk, and preserves commercial leverage across your entire vendor and contract vendor portfolio.

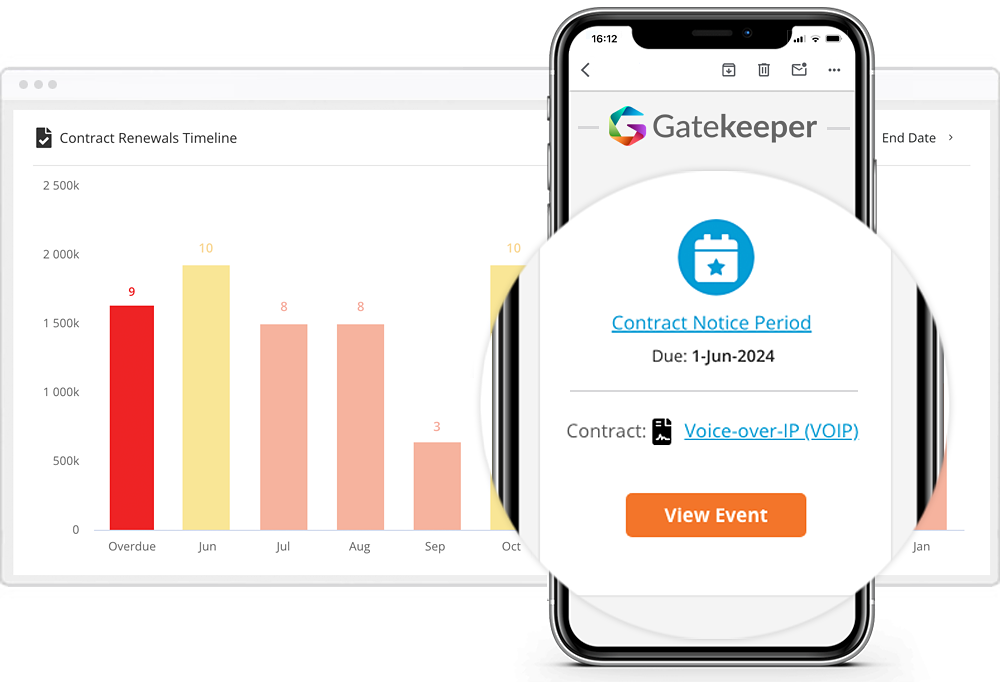

Contract reminder software helps legal and procurement teams stay ahead of key contract dates including renewals, expirations, and compliance reviews.

Basic tools might send alerts. But they don’t support accountability, risk evaluation, or financial impact. And they certainly don’t protect margins.

As your contract portfolio grows, these limitations become liabilities:

To manage risk, reduce wastage, and safeguard spend, you need more than reminders. You need automation that drives outcomes.

By ensuring timely notifications and structured workflows, contract reminder software reduces the risk of auto-renewals, missed obligations, and contract lapses.

The result? Better oversight, reduced risk exposure, and stronger commercial outcomes.

Missed contract dates aren’t just an operational oversight—they have measurable financial consequences:

Unintended auto-renewals: Lock you into outdated pricing and redundant services. Silent renewals quietly drain budgets and block resource optimisation.

Missed obligations: Lead to compliance breaches, audit failings, or even regulatory penalties, especially damaging in high-governance sectors.

Lost negotiation leverage: Short notice on renewals eliminates time for vendor evaluation, competitive tendering, or renegotiation.

Overlooked audits: Trigger last-minute scrambles and increase the risk of failed compliance reviews, potentially resulting in fines or reputational harm.

Fragmented ownership: When no one is clearly responsible, key dates slip through the cracks—exposing the business to financial and legal risk.

For CFOs, these aren’t operational issues. They’re revenue leakages, unmanaged liabilities, and preventable cost centres.

Effective automation creates repeatable, scalable processes that reduce reliance on manual tracking and prevent profit erosion:

Automation turns risk into predictability. It transforms reactive processes into proactive management, protecting margin at every stage.

Contract reminder software, or contract lifecycle management software, should offer more than notifications, it should deliver control over contract-driven financial exposure.

![]()

Look for features that help Finance and Legal work in lockstep to protect the business:

Modern contract reminder software goes far beyond basic alerts. Today’s platforms combine visibility, automation, and intelligence to help legal, procurement, and compliance teams manage contract obligations with precision and confidence

For CFOs, contract visibility is strategic. When your entire portfolio is centralised and searchable, finance leaders gain the insight to manage risk, forecast accurately, and support commercial decisions with confidence.

Automated data extraction turns legacy contracts into trackable assets, surfacing key dates, clauses, and obligations. With robust permissioning, sensitive agreements stay secure, while every stakeholder stays aligned.

The outcome? Stronger governance, smarter collaboration, and better financial control.

Missed or unintended auto-renewals can lead to unnecessary costs, duplicate vendor spend or outdated services that no longer deliver value.

For CFOs, these hidden costs add up quickly.

With automated reminders, finance teams can proactively review vendor contracts ahead of time. This creates a critical window to assess performance, explore alternatives, renegotiate terms, or consolidate vendors.

Renewals become a strategic advantage, not a financial risk.

Efficiency is just the beginning. Automation ensures financial discipline by preventing missed renewals, enforcing approval policies, and eliminating manual errors.

Automated contract workflows that reflect your organisation’s structure help ensure spend is signed off by the right people at the right time.

Conditional logic adapts the process based on contract value, risk or category, keeping controls tight without slowing things down.

.jpg?width=724&height=468&name=Screenshot%20-%20GK%20-%20Document%20Expiry%20Kanban%20-%20Sept%2021-min%20(1).jpg)

Dashboards offer a real-time understanding of your contractual commitments, exposure and compliance posture.

Monitor milestones, track vendor obligations, and surface potential risks before they escalate.

With contract and vendor data in one place, you’ll drive better decisions, control costs, and increase business resilience.

Keeping third-party documentation up to date is critical for compliance. Expired insurance or certifications can expose the business to regulatory risk.

You can delegate responsibility to vendors, keeping internal teams focused while still maintaining oversight.

This builds a stronger audit trail and demonstrates control when it matters most.

Contracts that go unchecked often underperform. Having time-bound contract review points helps ensure obligations are being met and gives finance teams a chance to assess value.

Use alerts to trigger vendor and market reviews before renewal. With clear insights into performance, spend and vendor risk, your team can negotiate from a position of strength and pursue the best available terms.

-1.png?width=724&height=517&name=Screenshot%20-%20GK%20-%20New%20Contract%20Request%20Legal%20Review%20(1)-1.png)

Every missed date is a liability. Every automated workflow is a safeguard.

Gatekeeper’s contract reminder software drives strategic action. With real-time visibility, built-in governance, and automation at scale, you reduce financial risk and make smarter, faster decisions across your portfolio.

If your current approach relies on spreadsheets, inbox alerts, or disjointed systems, it’s time to upgrade.

Talk to Gatekeeper and see how our software protects your bottom line - by turning contract risk into business control.

Shannon Smith bridges the gap between expert knowledge and practical VCLM application. Through her extensive writing, and years within the industry, she has become a trusted resource for Procurement and Legal professionals seeking to navigate the ever-changing landscape of vendor management, contract management and third-party risk management.

Sign up today to receive the latest GateKeeper content in your inbox.

Copyright © 2015 - 2025. Gatekeeper™ is a registered trademark.

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.