Why Poor Contract Visibility Is The Silent Killer Of CFO-Led Cost Reduction

11:35

This website stores cookies on your computer. These cookies are used to improve your website and to provide more personlised services to you, both on this website and through other media.

To find out more about the cookies we use see our Privacy Policy.

Contract Visibility, Vendor and Contract Lifecycle Management, Office of the CFO

Shannon SmithFeb 19, 2025 9:05:28 AM

A recent Deloitte report revealed 52% of finance leaders rate cost reduction as their top priority for 2025.

Vendor consolidation, budget cuts, and procurement optimisations are all strategic levers. Yet one silent, overlooked factor continues to erode financial efficiency - poor contract visibility.

Many CFOs are still using manual, siloed approaches to manage their vendor and contract lifecycle. Spreadsheets, email chains, and legacy systems result in missed renewals, uncontrolled spending, and compliance gaps. The financial impact? Higher costs, increased risk exposure, and inefficiencies that compound over time.

In this article, we look at the true cost of poor contract visibility and how automating vendor and contract management can lead to better results for CFOs and their organisations.

When contracts are stored across multiple systems - SharePoint, JIRA, email, desktops, and even printed files - businesses lack a single source of truth.

This creates inefficiencies in tracking key clauses, payment terms, and service obligations. CFOs are left scrambling to locate critical information when issues arise, often relying on procurement or legal teams who have fragmented visibility themselves.

This lack of transparency often leads to duplicate vendor payments, contract overlaps, and difficulty in assessing vendor performance. Without structured oversight, businesses can end up overpaying for services they no longer use or missing opportunities to consolidate spending across fewer, more strategic vendors.

A centralised vendor contract repository ensures CFOs and their teams can instantly access payment schedules, renewal terms, and performance reviews - reducing wasted spend and financial inefficiencies.

Without automated workflows tracking vendor contracts, renewal management becomes reactive rather than strategic. Without clear oversight, contracts auto-renew unnoticed, locking finance teams into outdated pricing, unfavourable terms, and suppliers that no longer align with business needs.

CFOs often only realise the financial impact when budget overruns emerge, exposing agreements that have continued unchecked - often at rates set under outdated market conditions.

Beyond financial risk, missed renewals strain supplier relationships. Suppliers expecting renegotiations or contract adjustments may view finance and procurement teams as unreliable when last-minute changes disrupt planning.

Automated renewal workflows eliminate these risks by proactively flagging upcoming deadlines and triggering approval processes before commitments are locked in.

CFOs are not just responsible for cost control - they are increasingly accountable for ensuring financial compliance.

Many assume contract compliance is strictly a legal responsibility, but in reality, contractual obligations affect financial performance, audit preparedness, and overall business stability.

Without automated tracking of contract terms and compliance requirements, CFOs risk regulatory breaches, missed audit requirements, and even personal liability.

With the Sarbanes-Oxley Act (SOX), for example, CFOs must personally certify that financial statements and disclosures are accurate and do not contain material misstatements. Failure to comply (fraudulent certification or gross negligence):

CFOs need clear and real-time visibility into vendor spend to drive effective cost reduction. However, in manual environments, financial teams struggle to get an accurate view of how much is being spent, with whom, and on what services.

This lack of insight means that budgets are often set based on outdated information rather than current, strategic vendor data.

Poor contract visibility leads to reactive, rather than proactive, cost control measures. CFOs may only discover overspending when quarterly or annual reports flag unexpected cost overruns. By then, the opportunity to renegotiate, consolidate vendors, or adjust contract terms has passed.

With real-time contract and vendor spend tracking, CFOs can:

For CFOs, cost control is about eliminating inefficiencies, optimising vendor value, and ensuring financial resilience. A Vendor and Contract Lifecycle Management (VCLM) platform provides the automation and visibility required to achieve these goals.

With the right platform in place, businesses can ensure that vendor agreements, renewal deadlines, compliance obligations, and financial risks are proactively managed, eliminating costly oversights and giving CFOs control over spend before it escalates.

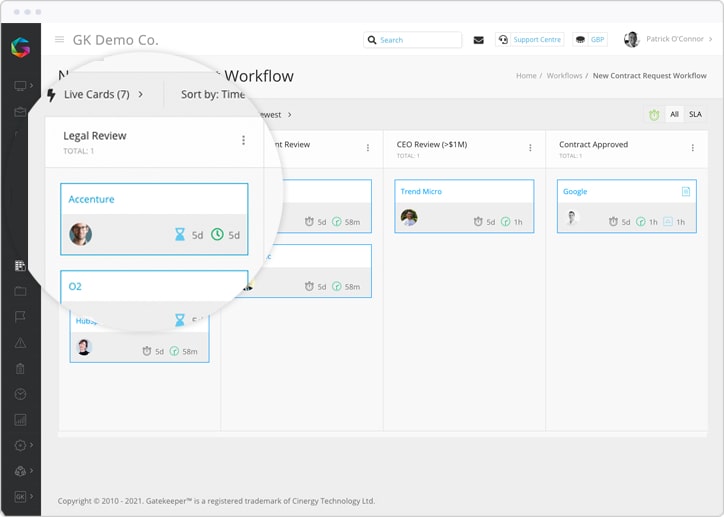

Instead of relying on manual tracking or scattered reminders, a. VCLM platform automates renewal oversight with a structured workflow.

Outcome: Eliminates surprise costs, improves negotiation power, and ensures spend is justified before contracts auto-renew.

Fragmented contract storage creates inefficiencies and financial risks. Gatekeeper provides a single source of truth for all vendor and contract data, ensuring CFOs have immediate access to:

Outcome: CFOs gain full control over vendor relationships, enabling better spend analysis and cost optimisation.

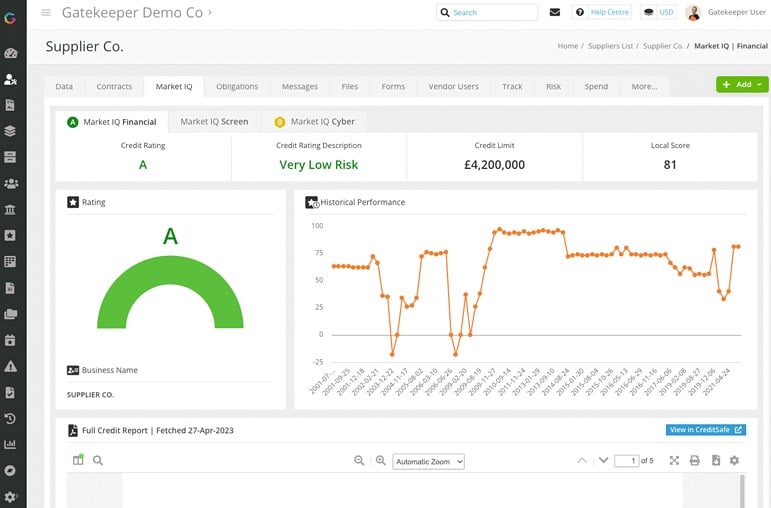

Financial risks don’t just come from within the business - they stem from vendors, too. Gatekeeper’s Market IQ Finance delivers real-time vendor financial health monitoring, automatically alerting CFOs when supplier risks emerge.

Outcome: Reduces financial exposure to high-risk vendors and ensures supply chain resilience.

CFOs need accurate, real-time spend data to make informed decisions. Gatekeeper’s spend analytics dashboard provides:

Outcome: CFOs can proactively manage spend, optimise budgets, and ensure every vendor provides measurable value.

For CFOs at businesses using NetSuite, Gatekeeper’s Built for NetSuite SuiteApp delivers an unparalleled level of contract and spend control inside the ERP environment. Unlike standard integrations, this SuiteApp is natively embedded within NetSuite, allowing finance teams to:

Outcome: A fully integrated, ERP-powered contract management experience that drives efficiency, improves spend control, and strengthens financial oversight.

For CFOs managing multiple financial platforms, Gatekeeper Interconnect ensures complete synchronisation of vendor, contract, and spend data across key financial systems. This bi-directional integration eliminates manual data entry, reduces financial discrepancies, and ensures real-time accuracy.

Key benefits of Gatekeeper Interconnect:

Outcome: CFOs get a fully connected financial ecosystem, ensuring spend control, compliance, and cost efficiency across all business operations.

Cost efficiency is about having full control over vendor spend, mitigating financial risks, and ensuring that every contract actively contributes to business objectives.

Without a structured VCLM strategy, CFOs will continue to struggle with vendor sprawl, compliance gaps, and unmanaged renewals - all of which erode financial performance and create unnecessary operational friction.Investing in automation and centralised contract oversight transforms vendor and contract management from an administrative burden into a powerful tool for driving financial resilience and long-term growth. To find out more, book a demo today.

Shannon Smith bridges the gap between expert knowledge and practical VCLM application. Through her extensive writing, and years within the industry, she has become a trusted resource for Procurement and Legal professionals seeking to navigate the ever-changing landscape of vendor management, contract management and third-party risk management.

Sign up today to receive the latest GateKeeper content in your inbox.

Copyright © 2015 - 2025. Gatekeeper™ is a registered trademark.

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.