Why CFOs Can’t Afford to Ignore Vendor Management

1. The Financial Impact of Poor Vendor Oversight

Unstructured vendor management leads to uncontrolled costs, financial inefficiencies, and regulatory non-compliance. Without centralised oversight, businesses risk:

- Unplanned spend: Lack of visibility into vendor contracts can lead to costly auto-renewals and duplicate payments.

- Eroded Profit Margins: Without strategic oversight, vendor costs can escalate, impacting overall financial performance and reducing profitability.

- Inaccurate financial forecasting – Disorganised vendor contracts make it difficult to predict expenses accurately, affecting budgeting and cash flow.

2. Regulatory & Compliance Risks

Weak vendor oversight can lead to compliance violations, financial penalties, and reputational damage. CFOs are increasingly held accountable for ensuring vendor contracts align with regulatory requirements to mitigate these risks:

- GDPR Non-Compliance: Data breaches from third-party vendors can result in fines of up to €20 million or 4% of global annual revenue, with CFOs potentially facing personal liability for governance failures.

- SOX Violations: Inadequate financial controls in vendor agreements can lead to misstated earnings, SEC investigations, and criminal penalties, including CFO fines or even imprisonment.

- Industry-Specific Penalties: Non-compliance with regulations such as Basel III (banking) or HIPAA (healthcare) can trigger multi-million-dollar fines, investor lawsuits, and executive accountability under evolving corporate liability laws.

3. Operational Risks & Business Disruptions

Manual vendor management creates operational inefficiencies that impact service delivery and business continuity. Without a streamlined system, businesses risk:

- Delayed approvals: Slow contract sign-offs leading to stalled operations and revenue loss.

- Missed contract obligations: Inadequate tracking causing financial penalties and compliance breaches.

- Increased business disruptions: Inefficient vendor processes resulting in project delays and service interruptions.

Common Vendor Management Challenges for CFOs

1. Lack of Visibility into Contract Obligations

For CFOs, managing financial commitments requires absolute clarity over contractual obligations, yet many organisations operate with disjointed, decentralised contract management systems. This results in:

- Uncontrolled renewals: Auto-renewing contracts without thorough cost-benefit analysis can result in unnecessary expenses.

- Undetected financial risks: Hidden penalty clauses and non-compliance fees can go unnoticed until it’s too late.

- Inefficient audits: Without a centralised contract repository, tracking vendor spend against budget forecasts becomes a laborious and error-prone process.

Daily, CFOs need instant access to vendor agreements to inform cash flow decisions, budget allocations, and compliance reporting. Without this visibility, financial strategy is reactive rather than proactive.

2. Vendor Risk Exposure

CFOs are increasingly accountable for enterprise risk management, and vendor-related risks are a growing concern. Many organisations fail to conduct adequate due diligence, exposing themselves to:

- Data breaches: Third-party vendors mishandling sensitive information can lead to severe financial and reputational damage. 54% of organisations experienced a third-party data breach in the past year.

- Regulatory fines: Compliance violations due to vendor mismanagement can lead to hefty penalties and operational disruptions.

- Reputational damage: A poorly performing vendor can damage customer trust, affecting revenue and market positioning.

Every CFO is tasked with ensuring risk mitigation strategies are in place, yet vendor compliance is often overlooked. This leads to reactive crisis management rather than structured, preventative action.

3. Manual Inefficiencies & Rising Costs

Vendor management remains highly manual in many organisations, consuming valuable financial and operational resources. CFOs face challenges such as:

- Fragmented approval workflows: Lengthy, unstructured processes delay vendor onboarding and contract execution.

- Disparate systems: Many businesses still rely on spreadsheets and email chains to manage vendor data, leading to duplication, errors, and inefficiencies.

- Lack of automation: High administrative costs and slow processes result in increased operational expenses.

To address these challenges, CFOs should adopt Vendor and Contract Lifecycle Management (VCLM) software to enhance control, automate compliance tracking, and improve financial oversight.

How VCLM Software Solves CFOs’ Biggest Pain Points

CFOs are tasked with ensuring financial stability, managing risk, and maintaining compliance, but traditional vendor management practices often hinder their ability to do so effectively.

With 43% of CFOs citing investment in new technology being the main area of change occurring in their organisation over the next 12 months, it's time to modernise.

VCLM software is designed to address these challenges head-on, centralising data and transforming vendor management from a fragmented, reactive process into a streamlined, proactive strategy.

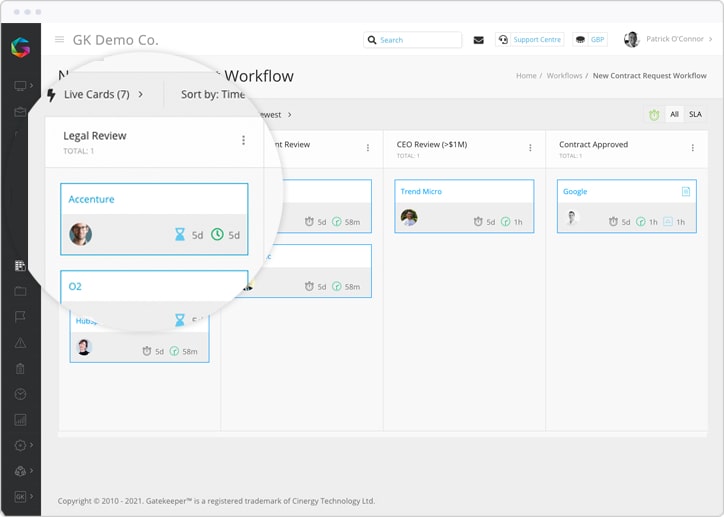

1. Automating Vendor Workflows to Eliminate Bottlenecks

Vendor management should not be a slow, manual process defined by endless email chains and approval delays. Gatekeeper automates workflows to ensure:

- Faster contract approvals – No more stalled negotiations or lost revenue opportunities due to sluggish sign-offs. Gatekeeper routes contracts through automated approval chains, ensuring they reach the right stakeholders without delay.

- Proactive renewal management – CFOs no longer need to worry about missed deadlines or auto-renewals that lock in unnecessary costs. Automated alerts highlight upcoming renewals, giving finance teams the chance to renegotiate better terms or cancel unneeded contracts.

- Better financial forecasting – With automated tracking of vendor commitments, CFOs gain complete visibility into upcoming expenses, making budgeting and cash flow management more predictable.

2. Strengthening Compliance with AI-Driven Risk Management

Regulatory compliance and vendor risk management are significant burdens for CFOs, who must ensure that all third-party engagements align with industry regulations. AI-driven risk intlligence provides:

- Real-time compliance monitoring – Automatic scanning and flagging of vendor compliance risks, allowing CFOs to take immediate action before they escalate.

- Risk scoring and categorisation – Vendors are evaluated based on financial stability, performance history, and regulatory adherence, helping CFOs prioritize relationships that offer the most strategic value.

- Audit-ready documentation – Instead of scrambling to compile compliance reports, CFOs have instant access to all vendor-related compliance documents in one secure, centralised platform.

3. Improving Profitiability with Enhanced Spend Tracking

Without clear oversight of vendor spend, organisations can easily fall into inefficient spending habits, leading to wasted resources and budget overruns. Gatekeeper helps CFOs:

- Centralise vendor contracts and financial commitments – No more searching through scattered spreadsheets or emails; all contracts, invoices, and financial terms are stored in one secure location.

- Gain full visibility over vendor spend – CFOs can access real-time dashboards that break down spending patterns, highlighting opportunities for cost reduction and consolidation.

- Identify cost-saving opportunities – AI-driven analytics suggest ways to renegotiate vendor contracts, eliminate redundant agreements, and optimise payment schedules to improve cash flow.

4. Ensuring Vendor Management Aligns with Broader Financial Operations

Without direct integration with enterprise resource planning (ERP) systems, vendor data remains siloed, leading to inefficiencies in financial reporting, spend tracking, and compliance oversight.

VCLM software eliminates these challenges through powerful integrations, ensuring CFOs maintain full financial visibility while streamlining operations.

Key Integration Benefits:

- NetSuite Integration: A VCLM platform that offers a seamless connection with NetSuite enables real-time visibility into vendor spend, automated financial reporting, and audit-ready compliance workflows - removing reconciliation headaches and improving cash flow management.

- Connection with other ERPs: As a central hub connecting finance, procurement, and legal, integrating with your chosen ERP ensures unified vendor intelligence, automated approval flows, and AI-driven compliance tracking, reducing data silos and strengthening financial oversight.

- Stronger Financial Control & Risk Management: By integrating vendor and contract data across key systems, CFOs gain greater control over financial commitments, enhance collaboration across departments, and mitigate compliance risks.

Watch how Redwood Logistics cut costs with Gatekeeper's native NetSuite Integration:

Steps CFOs Can Take to Improve Vendor Management in 2025

1. Assess Current Vendor Management Processes

CFOs must take a data-driven approach when evaluating vendor management efficiency. A thorough audit of existing processes will identify gaps in contract visibility, risk assessment, and compliance tracking. CFOs should consider:

- Are vendor contracts centralised and easily accessible? If agreements are stored across multiple systems or departments, tracking financial obligations becomes cumbersome, increasing the risk of overspending or missed compliance deadlines.

- Are compliance risks actively monitored? With increasing regulatory scrutiny, unmonitored vendors can introduce financial and legal liabilities.

- Are financial commitments aligned with business objectives? Without clear oversight, businesses risk paying for unnecessary services or failing to negotiate cost-saving opportunities.

A clear understanding of these pain points allows CFOs to create a roadmap for efficiency and risk mitigation.

2. Adopt VCLM Solutions for Automation

The adoption of Vendor and Contract Lifecycle Management (VCLM) software transforms vendor oversight from a reactive, manual process into a proactive, automated strategy. CFOs benefit from:

- Reduced administrative burden – Automated contract approvals and renewal alerts prevent costly auto-renewals and eliminate human error.

- Real-time compliance tracking – AI-powered systems highlight regulatory risks before they become critical issues, reducing exposure to fines and legal disputes.

- Optimised spend management – CFOs gain full visibility into vendor commitments, helping them to negotiate better terms and prevent financial inefficiencies.

By integrating automation into vendor management, CFOs ensure smoother financial operations, reduced costs, and improved compliance adherence.

3. Implement Risk-Based Vendor Segmentation

Not all vendors pose the same level of financial and operational risk. A risk-based segmentation strategy enables CFOs to allocate resources effectively, prioritising oversight where it’s most needed. This involves:

- Strategic importance – High-value, business-critical vendors require regular performance and compliance reviews to prevent operational disruptions.

- Regulatory exposure – Vendors handling sensitive data or operating in highly regulated industries should be monitored for compliance adherence.

- Performance history – Past performance metrics should guide decision-making on vendor retention or contract renegotiation.

This structured approach helps CFOs mitigate vendor-related risks while maintaining strong, strategic partnerships.

4. Foster Cross-Functional Collaboration

Vendor management is not solely a finance responsibility—it requires alignment across finance, legal, procurement, and IT teams. CFOs should lead efforts to break down silos by:

- Partnering with procurement – Ensuring vendor selection aligns with long-term financial and strategic goals.

- Engaging legal teams – Maintaining contract integrity and mitigating potential liabilities through structured compliance frameworks.

- Collaborating with IT & Security – Protecting the organisation from third-party cybersecurity risks by embedding vendor security checks into procurement processes.

Cross-functional collaboration ensures vendor management is an enterprise-wide priority, enhancing operational resilience and financial efficiency.

The future of the CFO role in Vendor Management

CFOs must view vendor management as a strategic priority, not just an operational necessity. Without a structured, technology-driven approach, businesses risk financial inefficiencies, compliance breaches, and operational disruptions.

By adopting VCLM software, CFOs can achieve:

- Better cost control: Reducing unnecessary expenses and optimising vendor contracts.

- Stronger compliance: Ensuring vendor relationships meet regulatory standards.

- Improved risk management: Using AI-driven insights to mitigate financial exposure.

Now is the time to take a proactive approach. Explore how Gatekeeper can help your organisation optimise vendor and contract lifecycle management. Book a demo today.

.png)

.png)

.png)

-4.png)