This is a significant saving on the bottom line that is almost impossible to do when you’re manually running your vendor and contracting operations.

Another massive benefit of a VCLM approach that integrates the elements of vendor lifecycle management (VLM), contract lifecycle management (CLM), and third-party risk management (TPRM) is savings on renewals.

Often, renewals are left to the last minute across different teams without the proper legal focus on improving contracts, and the discussion around leveraging cost reductions is missed.

With a VCLM platform containing your renewal dates, risk information, and the right people to tackle this, you can expect improved contract renewal management with your vendor contracts.

The Telegraph experiences this working with Gatekeeper. They stopped missing renewals. This sounds minor, but too many organisations get trapped in a vicious cycle of auto-renewals for vendor services they no longer need.

You can only address these with that foundational layer of visibility in place.

What you do next, once you have that visibility layer in place, is take control over your vendor base to protect your bottom line.

The Power of Control in Vendor Management

Control in vendor management is not just about setting rules; it's about ensuring these rules align with the organisation's financial goals.

One of those areas that can lack rigour without a centralised platform is vendor onboarding.

With poor vendor onboarding, you’ll often find a scatter-gun approach to bringing vendors onboard to work with you. This often means you have no idea of your spending with vendors or their risk profile, and you open yourself up to fraudulent vendors working their way into your operations."

It’s chaos.

No CFO wants this. Neither does Procurement. But it happens.

So, this isn’t a checkbox exercise.

It can genuinely impact the bottom line.

With a VCLM platform, you can create a dedicated vendor onboarding workflow that carries out all necessary due diligence to ensure vendors who work with you meet the expected standards."

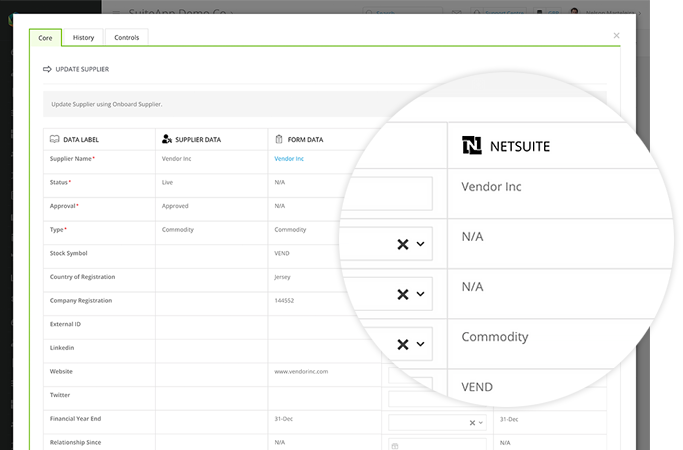

Integrating this vendor management process with financial systems like NetSuite takes this further.

It allows finance professionals to work within a familiar platform, and they know that the vendor data they rely on in NetSuite is accurate and up-to-date.

This integration means that every purchase order and invoice is linked to a corresponding contract, providing a clear audit trail and further safeguarding against financial discrepancies.

NetSuite states that “small businesses experience billing fraud twice as often as their larger counterparts, according to an Association of Certified Fraud Examiners (ACFE) report”.

This connection between vendor management and financial systems ensures that CFOs can trust the data they use to make crucial decisions, enhancing efficiency and integrity in financial operations.

We talked about the siloed approach at the start of this article. The level of connectivity between Gatekeeper and NetSuite removes the silos.

NetSuite within Gatekeeper

NetSuite within Gatekeeper

Compliance as a Strategic Tool for the CFO

For CFOs, compliance is not just a checkbox exercise; it can make or break growth and kill the bottom line if a regulator fines you.

Ensuring vendor relationships comply with legal and ethical standards is integral to maintaining continuity and resilience.

Regular credit checks and risk assessments are not mere formalities but are critical in aligning vendors with the organisation's values and compliance requirements."

The cyber health of your vendors is perhaps more important, primarily since regulations, such as GDPR, are focused on disclosures of data, and a weak vendor somewhere in your supply chain could cost you a lot.

British Airways received a €22.4 million fine when their website traffic was directed to a hacker website.

The ICO official statement: “…investigation found the airline was processing a significant amount of personal data without adequate security measures in place. This failure broke data protection law and, subsequently, BA was the subject of a cyber-attack during 2018, which it did not detect for more than two months.”

Imagine if one of your vendors was breached, and they handled sensitive information on your behalf, but you had no idea that this happened. This scenario has substantial personal pain as it can be challenging to come back professionally if you were at the helm when a vendor breach like this happens.

So when one of your vendors is hacked, our VCLM platform will start a risk mitigation process to address the concern and make people across your business aware and in the know. A lack of knowledge isn’t a good enough reason to claim innocence here.

This is why VCLM is mission critical for your business.

Closing Thoughts

Vendor and Contract Lifecycle Management is more than a set of procedures.

It is a strategic framework that empowers CFOs to protect and enhance the company's financial health.

Through enhanced visibility, control, and compliance in vendor management, CFOs can ensure that the organisation survives and thrives in today's competitive business environment.

VCLM, therefore, stands as a cornerstone of modern financial leadership, pivotal in driving the company towards its broader strategic goals.

If you're ready to learn more about VCLM, head over to our other resources.

.png)

.png)

.png)

-4.png)