The Contract Management function’s mission in life is to minimise contract-related risk. It does this by acting as the interface between the static, word-based 2D world of contracts and the dynamic, action-oriented 3D world we occupy.

In operational terms, this means conducting various activities including:

- Translating contract obligations into action items

- Calendarising those action items with appropriate lead times

- Informing stakeholders of their responsibilities and important dates

- Liaising with all contracted parties as necessary

- Monitoring the timely performance of scheduled actions

- Dealing with the consequences of unacceptable behaviour

- Anticipating and adapting to change and uncertainty.

Measuring how well this work is done is important to:

- The Contract Management function, to show where the critical problem areas are and how they’re trending

- The organisation, to show how the Contract Management function is delivering value for money through its risk minimisation efforts, and if it appears to be adequately resourced.

The types of measurements that can be useful and meaningful are outlined in our earlier article Contract Management KPIs – Measuring What Matters.

We now need to take the notion of what measurements matter in Contract Management up a level, to look at what matters most.

Why? Because identifying the right things to measure can be hard. Measuring the wrong things or not enough of the right things can produce a misleading impression and send you off in the wrong direction or unwittingly ignore a looming problem.

Ignorance is not bliss – what you don’t know really can really hurt you.

In this article, we’ll provide a comprehensive list of the essential goals and measures that need monitoring in a high-performing contract management function. We’ll cover the rationale for ‘what matters most’, the key elements of measurement, and the importance of context in understanding the as-measured positions.

The lowdown on ‘what matters most’

Lots of measures can be interesting, even intriguing in a ‘who knew?’ kind of way, but otherwise not all that useful for indicating how well the Contract Management function is doing its job.

Consider a car’s instrument panel with its handful of gauges showing measurements that the manufacturer has deemed to matter, things like vehicle speed, engine speed, fuel remaining, battery charge level, engine temperature level, fuel usage rate, distance travelled this trip and cumulative distance travelled.

What matters most to your average driver though? Speed, in order to comply with the posted limit, and fuel remaining, in order to determine when to fill up.

So, the essential gauges are the speedometer, viewed every few seconds, and the fuel gauge, typically viewed just on starting the car and possibly never again for any particular journey unless it’s clear that refuelling is necessary during the trip.

But what’s the purpose these days for a tachometer, the gauge indicating how fast the engine is running? On a daily commute or road trip, how often are you likely to check this gauge and take action as a result? Rarely, if ever.

Then there’s the fuel consumption rate indicator that displays in real time the blindingly obvious: you’re using so much more fuel going up that steep hill than you are coasting down the other side. Sure, this display might have helped you adjust your driving habits initially but since then?

How about the engine temperature gauge? Surely just a warning light would suffice if the temperature was ever a problem.

For most people, most of the time, these three gauges are simply a waste of dashboard real estate.

The situation’s the same with Contract Management measures. You really only need to regularly see the essential information, like that from the speedo and the fuel gauge. Other information that might be required from time to time could still be made available, but only on request or if some threshold is reached, like an overheating engine warning light.

The emphasis on things that matter most has two purposes:

- To focus attention. Lots of things can and do matter to a variety of stakeholders, but these are often localised and essentially irrelevant at the big picture level where you want understanding of how well you’re doing.

- To separate the wheat from the chaff. Important information needs to be delivered to your door or be easy to find. Having to search for it is unnecessarily time-wasting and distracting.

Key elements in measurement

A goal is an outcome, typically stated without any dimensions, needed for accomplishing a mission.

Goals drive measurement.

A measurement ascertains the level of achievement of a goal at generally regular points in time, by collecting and manipulating in some fashion the base information needed.

Measurements reveal performance.

Many measures relate to quantities, which are absolutes – two always means two.

Aspects like quality or achievement are often relative, where a meaning is derived from comparison of an absolute against a scale or benchmark. For instance, two on a scale of 10 could be bad or good, depending on whether successes or failures are being measured in respect of the results of 10 attempts at something, and the target settings for defining the difference.

A target is the minimum level of goal achievement deemed acceptable. It can be set low initially and increased over time to correspond with a staged rollout of capability where a big bang approach is not viable.

Targets define performance.

Starting too high with targets will only apply a pressure to perform that is unnecessary. Making a rod for your own back rarely leaves you without bruises. Far better to start with something that sounds fairly achievable and see if it turns out to be the case. The outcome should provide clues about whether to increase or decrease the target setting, and by how much.

Having said this though, achieving a target of 100% may actually be required from day one in some cases, like contract amendment approvals or regulatory compliance, where any below-target performance can have really serious financial, reputational and personal consequences.

Every organisation will have different levels of Contract Management maturity, systems capability, expertise and workload, all factors that will have an influence on target setting.

A trend indicates the direction the level of goal achievement is heading in - decreasing, steady or increasing. It is derived from the comparison of a current measurement against an earlier measurement.

Trends trigger adjustment.

Progress towards goals needs to be measured and tracked over time to identify any undesirable trajectories that could lead to the mark being missed, allowing appropriate corrective actions to be taken or the target to be reset to something more realistically attainable.

Essential Goals and Measures

For Contract Management, the goals leading to the measurements that count should focus on the contracts that count. These are the organisation’s key and important contracts, the subset of all contracts that it’s feasible to manage on a regular basis.

It’s certainly the case that risk can still arise in relation to any of the unmanaged contracts. However, the reasonable expectation is that the potential impact of such an occurrence will be minor in comparison to that for a managed contract. Never discount Murphy’s Law though.

The reality is that virtually nobody really has the resources available to effectively manage their entire contract inventory, and the line has to be drawn somewhere. It’s easy enough to place an unmanaged contract under management if and when circumstances dictate.

The measures pertinent to the essential goals will provide the evidence to support or refute any claim by the Contract Management function that their risk minimisation activities are delivering to expectation.

The measurements collected for each goal and any calculated ratios should be reported fairly quickly after the end of the reporting month. The details should cover the reporting month and cumulative year-to-date, plus the current month vs prior month trend along with any applicable target values.

The high-level figures should always be reported, with an option to view the underlying details where practical.

How do you measure contract performance?

In the table below, we outline what goals and measures you should focus on. These include:

- Approval of contract amendments

- Compliance with contract obligations

- Compliance with regulatory obligations

- Initial review of contracts provided by a supplier

- Annual relevance review

- Critical contract dates being met

- Visibility of supply chains

- Supplier service delivery targets

The following goals are proposed as candidates for essential status. Others can be expected to come and go for an organisation’s particular situation and point in time. Responses to uncertainty, volatility and change may deliver insights that lead to further essential goals. A close watch should be kept in case this happens.

| Goal | Monthly Measures |

|

1. Approval of contract amendments, to:

|

Number of:

% ratio of b:a, c:b |

|

2. Compliance with contract obligations, to:

|

Number of contracts:

% ratio b:a |

|

3. Compliance with regulatory obligations, to:

|

Number of contracts:

% ratio of b:a and c:b for each timing group |

|

4. Contracts provided by a supplier undergo an initial review, to:

|

Number of supplier-provided contracts:

% ratio of b:a and c:b |

|

5. Contracts undergo an annual relevance review, to:

|

Number of contracts:

% ratio of b:a |

|

6. Critical contract dates are met, to:

|

Number of:

% ratio of b:a, d:c and e:c |

|

7. Key supply chains are visible, to:

|

Number of suppliers:

% ratio b:a |

|

8. Obligations compliance is managed with contract-level plans, to:

|

Number of contracts:

% ratio of b:a |

|

9. Supplier service delivery targets are met, to:

|

Number of contracts:

% ratio of b:a |

The Importance of Context

Reporting of the essential measurements in isolation can only tell half the story. What’s missing is the context needed to reveal proportionality. That’s the size of the problem being addressed compared to the entire problem space.

In other words, proportionality shows the ratio of managed contracts to unmanaged contracts. It’s likely to be fairly small, but that doesn’t necessarily mean it’s a cause for concern.

That’s because unmanaged doesn’t mean ignored. It just means that very little attention is needed by most contracts for the duration of their term, either because of the simplicity of the services provided or the lack of any real impact of an interruption to those services.

There’s likely to be little need for regular formal communications and meetings with the supplier of an unmanaged contract because business is typically transactional, relatively low value or infrequent, and there’s often plenty of alternative suppliers if needed.

The major commonality between managed and unmanaged contracts is they both get the required amount of attention in the lead-up to end-of-term with respect to renewal or termination.

Despite the relatively low-risk nature of the vast majority of unmanaged contracts, it’s worthwhile seeing the proportionality numbers regularly to fully understand the overall context about contracts. A hint of something requiring attention might be revealed. Some nervousness about the low managed-to-unmanaged ratio might result in a push to raise it, with all that entails with respect to resources.

In this sense, the context figures enhance the value of the essential numbers, rather than present a time-wasting distraction.

The following contract-related numbers can provide the desired context:

- The total number of active buy contracts

- The number of active suppliers under contract

- The total annual spend with contracted suppliers

- The total number of active sell contracts

- The number of active customers under contract

- The total annual revenue received from contracted customers

- The average monthly number of new contracts, renewals, terminations and amendments from March 2019 to February 2020, and since then.

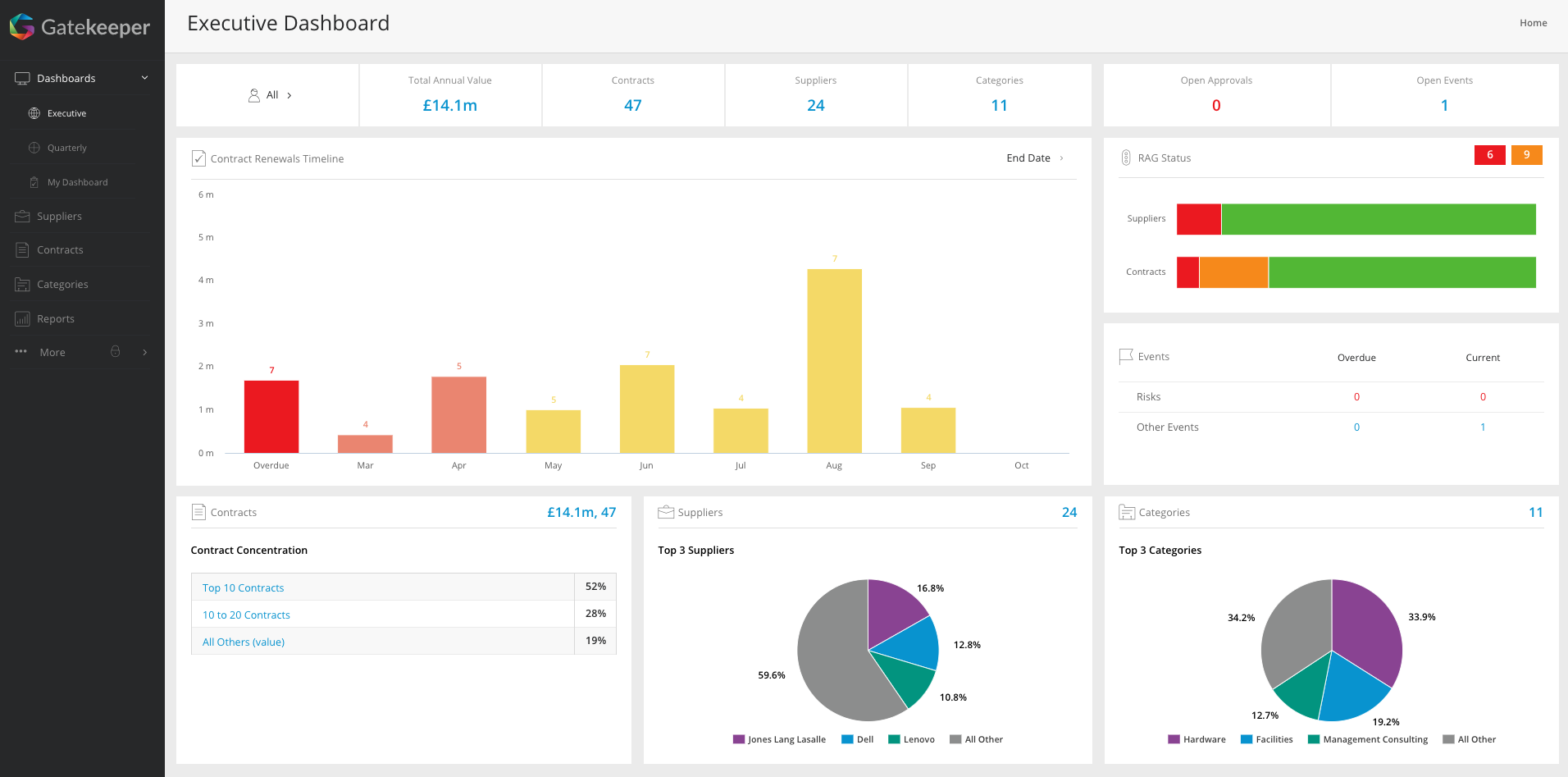

For those with more advanced requirements, or a large number of contracts requiring management, Gatekeeper easily aggregates this information and presents it in a series of clear dashboards.

See everything in one place with Gatekeeper's Executive Dashboard

See everything in one place with Gatekeeper's Executive Dashboard

Gatekeeper removes the need for manual data-gathering and instead automatically pulls in the relevant information from contract records, from workflow actions and from audit trails.

Summary

Lots of things get measured these days because they must or can be. Conversely, lots of things that should be measured aren’t, often because the need is not all that apparent, or you don’t know what you don’t know.

Much measurement is conducted in accordance with the generally accepted maxim that you can’t manage something, or improve it, if you don’t measure it. That’s good.

But it needs to be tested, to check if the measurement effort has delivered the expected manageability or improvements.

If so, the right things are likely being measured, or at least enough of them to make a difference.

If not, the prime suspect would have to be what’s being measured. Is it really relevant? Is it a case of trying to use a tachometer to determine road speed?

It’s past time when the maxim should be updated, to make explicit what’s too subtly implicit. Just a few extra words will do the job:

You can’t manage something, or improve it, if you don’t measure what matters most or measure it properly.

Measurement has value. It can reveal hidden secrets, provide important insights, encourage better performance, uncover a lie, guide improvement.

Having too many measures can create noise. Too much noise makes it easy to miss the message.

Making the essential measurements, the ones that matter most, is what matters most.

If you would like more information about measuring what your Contract Management function does and how well, or how Gatekeeper can assist with those activities, access our free contract management resources or contact us today.

.png)

.png)

.png)

-4.png)