Presenting information to auditors - whether internal or external - requires careful preparation, high levels of resource and lots of time. If your business is manually storing its contracts, has fragmented processes and can’t easily locate information, preparing for an audit can be a huge challenge and risk your chance of success.

Some businesses may have a dedicated compliance team to handle audits, but it’s likely that information-gathering and preparation will touch stakeholders across the entire business. To ensure the success of an audit, all teams should be equipped with technology that gives them visibility of all their contracts, drives efficiency when pulling evidence together and allows them to control what information auditors can access.

In this article, we’ll outline how to prepare for audits and how CLM software can be used to streamline the process and help to prove compliance.

What types of audits does a business have to prepare for?

Regulated businesses are all unique, but the laws and regulations they need to comply with aren’t. Businesses undertake audits for many reasons and activities can vary between each - usually dependent on the industry the business operates in. Some audits may apply to some businesses based on regional jurisdictions or national regulations too.

Types of audits can include (and are not limited to):

- Information system audits especially for those working in SaaS and IT environments. Businesses will need to provide evidence that they are working to agreed standards for certifications such as SOC 1, SOC 2 and ISO 27001 for example. These audits happen annually, allowing businesses to evidence their adherence and keep their certification live. Businesses have to demonstrate that data privacy is protected, everything is being done to ensure systems can’t be breached and that unauthorised parties can’t make changes.

- Financial audits completed by bodies such as the FCA. Independent auditors conduct these investigations to assess the accuracy of a business’s financial statements. Records of transactions, accounting entries and payment procedures are audited and a report provided after. These are usually completed annually and ensure that fraudulent activities are not taking place.

- Internal Audits which are completed by an independent body. Organisations carry out internal audits to ensure teams are complying with policies and processes which usually underpin the control standards for certifications. These can happen on a 1-4 times a year frequency and are usually found in more regulated or more mature organisations. The results of internal audits are often presented to shareholders to demonstrate that risk management and governance are being carried out effectively.

- Data Protection audits which vary by region. There is a particular request named a “Data Subject Access Request”. Anyone within the UK or an EU member state (under UK-GDPR under the DPA2018 or GDPR) can bring such a request to any organisation that stores, accesses or processes personal data where they think such data is held. This isn’t a typical audit but it operates one as the business needs to provide all information on that Data Subject and show how it is being used in the first instance.

How to prepare for an audit

Whether your business has to prove compliance with financial regulations, security laws or performance requirements, being able to evidence your internal processes and controls is vital. When it comes to presenting information to auditors, they usually ask for everything to be provided as evidence into their own file area on a network. Evidence can also be delivered personally during a face-to-face meeting - common before Covid-19 hit.

This means providing:

- Physical copies of documents (certificates, standards etc) for in-person meetings

- Screenshots to show that you are following internal policies for remote meetings

- Any documents, emails and communications that fall within the scope of the audit

- Internal policies, processes and governance guidance

- Reasoning for why some processes haven’t been followed (such as exemptions).

Preparing for an audit is all about information gathering. If you don’t know where your contracts, certificates and communications are - or if they are all over the place - preparation will be more difficult. Your business could have a harder time proving compliance as key contracts and documentation can be easily missed.

If your business wants to avoid audit failure, watch this video below

If your business is reliant on manual processes, multiple storage solutions and high levels of resources to establish audit-preparedness, it may be time to equip your teams with better technology. A CLM solution can help your business with restoring visibility, taking control of your processes and safeguarding compliance.

Below, we take a look at how Gatekeeper - the leading contract and vendor management software - can support your business ahead of its audits.

1. A central repository to store all audit-related records

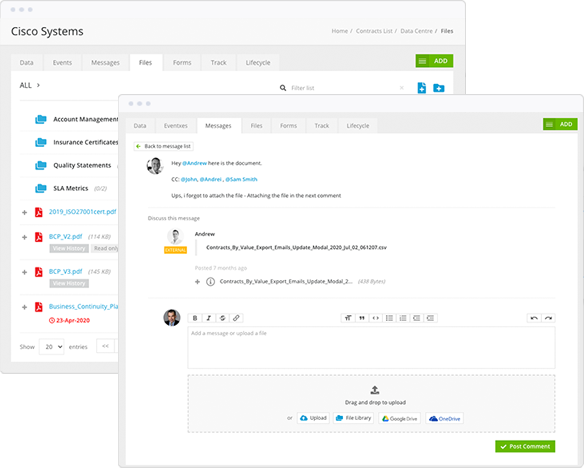

We established earlier that the largest part of any audit is gathering information. Rather than having contracts, vendor records, metadata and different versions of documents all over the place, businesses should opt for a central repository. Centralising all information in a single, secure location - with access given to the right teams - streamlines audit-preparedness.

Gatekeeper’s contract repository creates a single source of truth. All teams know where to go for the information they need. Using a powerful OCR engine, the repository is completely searchable from anywhere in the platform - so teams can quickly find the information they need. This reduces the amount of time and resources needed to collect evidence.

Contract and vendor management software restores visibility so that your business’s compliance team and any auditors can have the information they need at their fingertips.

Store all your contracts and related documents in a single, secure location

Store all your contracts and related documents in a single, secure location

2. Access a complete history of actions and contract lifecycles

A limitation of manually managing and storing contracts is how teams deal with versioning. Often, different copies of the same agreement are stored in a variety of places - with teams not always knowing which is the correct version.

If outdated or incorrect information is presented during an audit, it can have a damaging effect on the business’s results and reports. In a wider context, this can also risk damage to the business’s reputation and its bottom line if financial penalties are given as a consequence.

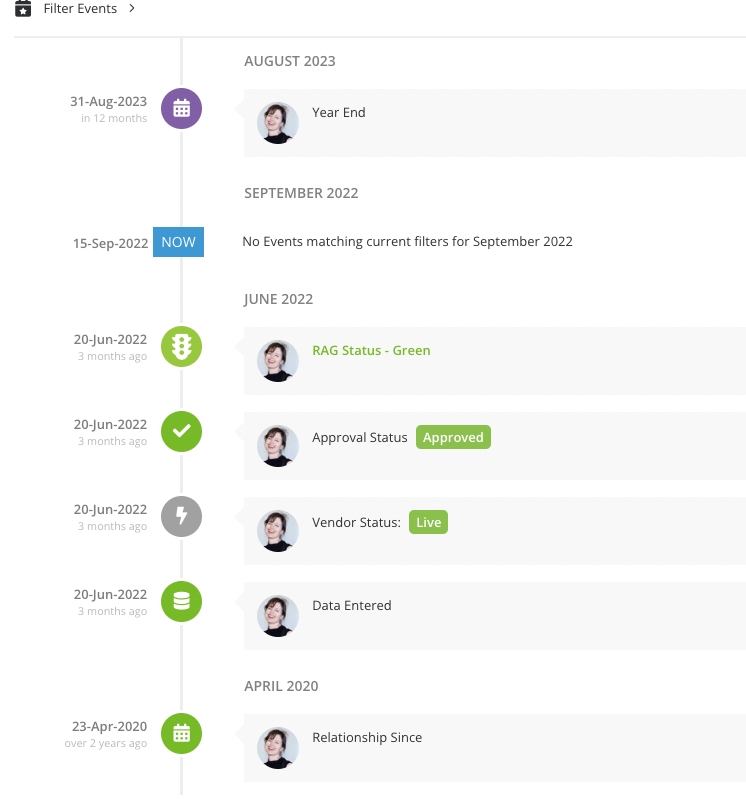

Gatekeeper helps businesses to control their versioning not only by capturing the latest version of a contract, but also recording any action and changes made. Users are able to search through every action taken on the platform and have the ability to export the data.

This is particularly useful when having to explain how processes have been followed such as onboarding a vendor and even why a procedure may have failed.

An auditable history is a defensible one. It leaves no rooms for obscurity or ambiguity when an external party is assessing the way your business operates.

Build an auditable and defensible history of all actions taken against a record

Build an auditable and defensible history of all actions taken against a record

3. A Kanban Workflow Engine that visualises processes

Auditors expect to see your processes, and how they are adhered to, in very fine detail. If anything is amiss, it will become a review point. Where there are failings, your business will often be due another visit in a designated period of time to see how your processes have improved.

Auditors will want to see that any failings have been remedied and that your processes have been fortified and any instances of non-compliance have been addressed.

The compliance team - or whoever is involved in preparing information - really has to paint a complete picture for the auditor. For many businesses, demonstrating a process end-to-end requires printing out hundreds of screenshots, laying out procedures and numbering any additional documents that need to be attached.

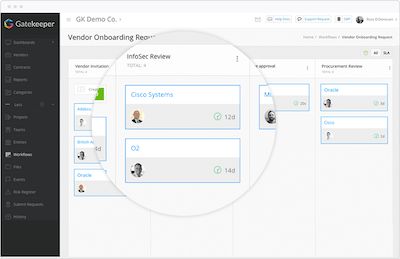

The Kanban Workflow Engine from Gatekeeper minimises some of the manual requirements. Offering a far more visual demonstration of internal operations, it helps your business to present how it onboards vendors, reviews their performance and mitigates risks in a far more digestible way. Each card, trigger and owner is easy to see.

An independent, objective assessor may not understand the nuances of your business and the context of its operations. The clearer your processes are for them, the better."

Demonstrate internal compliance procedures easily with the Kanban Engine

Demonstrate internal compliance procedures easily with the Kanban Engine

4. A robust register for showing that you manage risks properly

Regulated businesses often handle sensitive information day in, day out - making them an ideal target for cybercriminals. Being able to demonstrate how your business protects itself from external breaches, keep data secure and process personal information properly. These types of risks are likely to surface during an ISO/SOC audit.

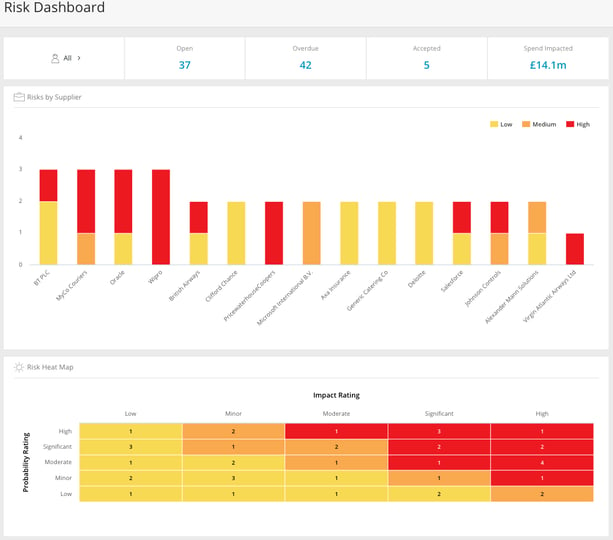

Gatekeeper offers a dedicated Risk Module, complete with a risk register, to help you track, analyse and mitigate potential issues. Its visual dashboards make it easy for auditors to view risks by supplier, type and category. A Risk Heat Map also makes your prioritisation for risk mitigation clear to auditors.

The Risk Register helps provide a visual, editable and searchable view of all risks - useful for businesses that are being audited based on Governance, Compliance and Risk (GRC) Management. Risks can be presented in a number of ways, including via dashboards, but the full risk detail can be accessed via the Supplier section. You can see Open, Closed and Accepted risks and easily export all of this data ready for an audit.

Risk is inherent to any business that works with third-parties. While auditors understand that, they want to know what processes your business has in place to mitigate issues."

5. Integrations that support data sync between your tech-stack

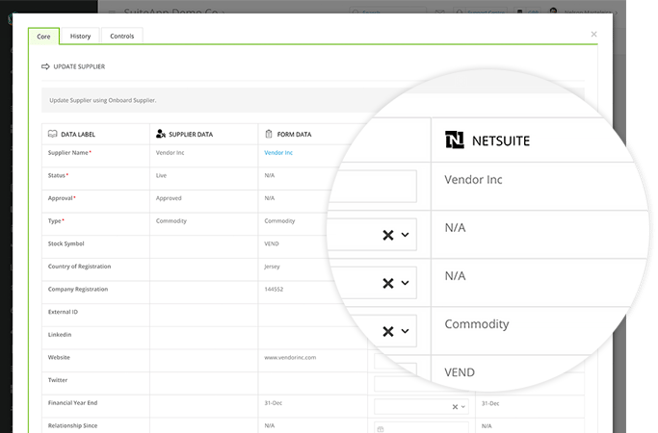

As well as using a number of manual methods to manage contracts it may be that your business has an extended tech-stack where particular departments have a pivotal role to play. Your finance team, for example, may be using NetSuite to monitor third-party spend. But if that software isn’t syncing seamlessly with whatever else you’re using, vendor data can be easily lost.

Gatekeeper is the only contract and vendor management software to offer a native NetSuite integration. The power of contract management can be unleashed within NetSuite as it offers full vendor data sync & vendor portal support. This means that vendors can input mandated data to improve overall accuracy and compliance.

The integration also allows for W-8 & W-9 tax form collection, perfect for any external financial audits. Native integrations improve the opportunity to increase efficiency, accuracy and demonstrate to auditors that risks are being minimised around compliance and regulation.

Gatekeeper brings controls and processes to life, even if your business uses an ERP. The combination of native integrations and the ability to sync data is invaluable.'

Sync data across your tech-stack with native integrations

Sync data across your tech-stack with native integrations

Wrap Up

Contract management software helps businesses to achieve audit-readiness by allowing them to restore visibility, take control of their processes and safeguard their compliance in a way that can be evidenced. With the right technology in place, preparing for an audit is much more efficient.

Processes can be demonstrated in a much clearer way and, with a complete history of actions taken, any remedial actions for failings can be tracked. Gatekeeper gives you the tools you need to remove some of the arduous administration that goes into being audit-ready; such as locating information, checking versions, and presenting information.

If you’re ready to find out more about how Gatekeeper can help you achieve audit-readiness, contact us today.

.png)

.png)

.png)

-4.png)